Can creating digital challenger banks give traditional financial institutions a competitive edge?

The digital transformation of financial services is seemingly unstoppable - and banks face several key challenges. These include how to integrate digital technology into all areas of the bank; how to rethink the way they operate and deliver value, and how to incorporate agility into banking culture.

Technology is enabling bank customers to manage their money safely and more conveniently. As a result, several digital-only alternatives have sprung up since the mid-2010s to offer a differentiated customer experience to traditional banking. In some markets, tech savvy users (mainly millennials and Gen Z) have flocked to these services.1

Furthermore, fintech start-ups have targeted some of the more lucrative segments of the market such as lending or international money transfer. To remain competitive in this environment, many traditional banks are re-looking at how they offer digital products and services to their customers.

It also presents the opportunity for traditional banks to think through how they can focus on what they already do really well or what they would like to be famous for in the future. Therefore, there are strategic imperatives to consider and there is a framework available to help banks decide whether creating a standalone digital challenger bank is the best approach.

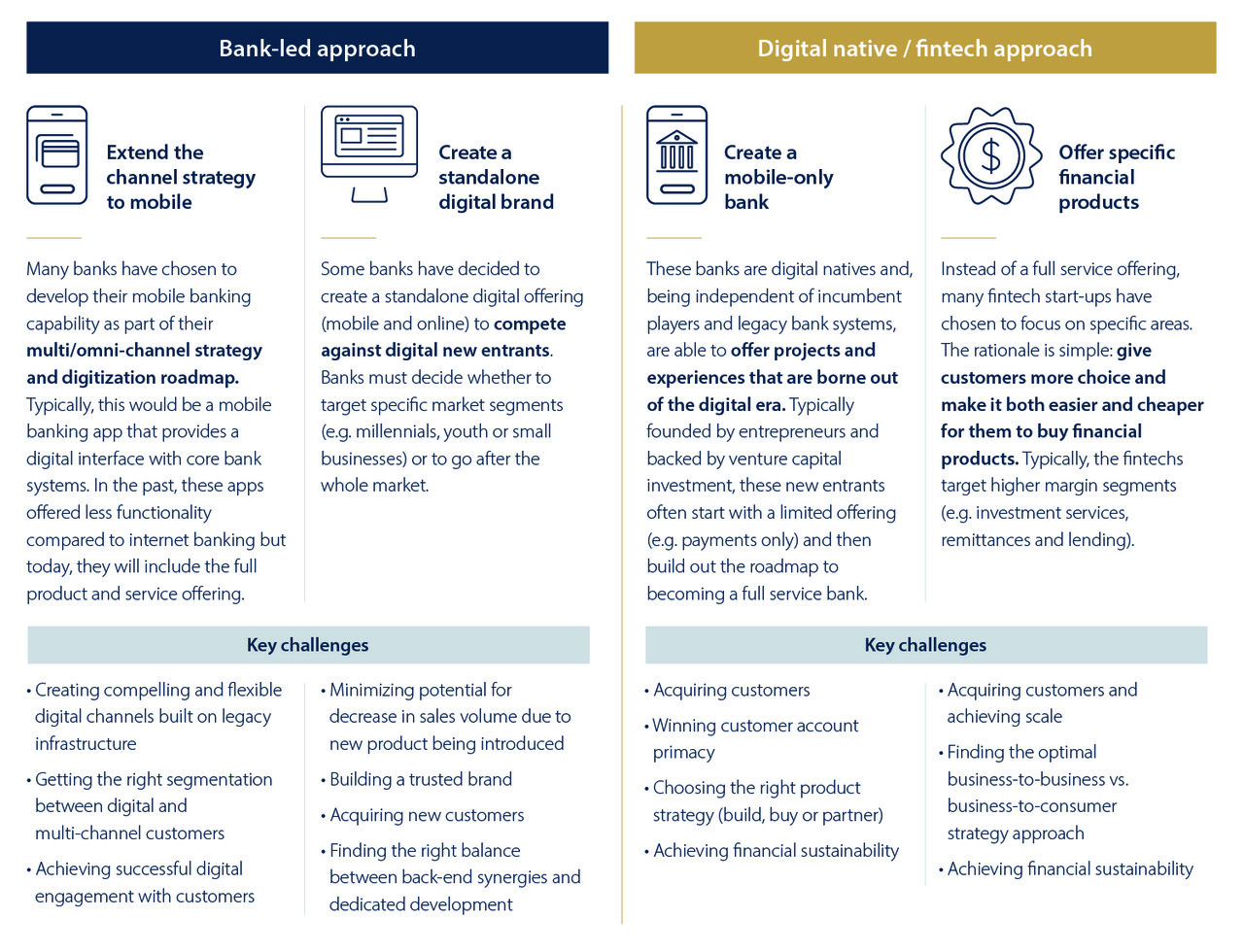

Ways to compete in digital banking

Banks and fintechs have taken distinct approaches to digital banking to date. While it is too early to tell which approach will prevail, banks are increasingly considering standalone digital bank brands to meet today’s customer expectations.

Why launch a separate digital challenger bank?

Banks that have chosen to launch a standalone digital challenger have done so for three main strategic reasons: to defend their market position; to go after new opportunities; or as a vehicle for learning about digital innovation.

- Defensive Play

In markets with many new digital entrants, incumbent banks are seeing their customers migrate some or all of their business to the digital banks. Even if they still retain the account, it may only be for commoditised services, e.g. deposits. To compete for and retain their customers, banks choose to create their own digital native offering. Capital One revamped their digital end-to-end experience for online shopping by providing new services such as post-purchase notifications, taking engagement and digital security to a new level. - Capture New Segments

Proactive banks will look to retain customers and will seek to utilise digital capabilities to win new business. These banks are looking to attract new market segments that are underserved by their core offering, e.g. youth, mass affluent or small business.

Intesa Sanpaolo has partnered with fintech Iwoca to provide its small and medium business clients with new credit products and support their growth. The partnership leverages Iwoca’s lending platform and Intesa’s expertise in building banking operations in order for Intesa to enter segments of the market not served by other players and competitors. - Test & Learn

Some banks are using their standalone operations to test innovation. In this environment, unhindered by parent bank processes and systems, it is quicker to test, learn about and launch new digital services. These learnings are invaluable when the propositions are subsequently integrated into the main bank.

BBVA (Spain) is a traditional bank that is heavily investing in and focusing on innovation, e.g. invested in digital banks Simple (US) and Atom Bank (UK) to drive innovation within the parent bank.

The route to market

Once a “go” decision has been reached, banks will need to factor in wider operational considerations, choose how to enter the market and develop an implementation roadmap.

Banks will need to decide how they plan to implement the new proposition and how they will use existing assets and products. There are four main pathways to building a digital challenger: adapting an existing solution, building from scratch, using a white label platform, or through acquisition. These pathways are not mutually exclusive, and each comes with different benefits and disadvantages that must be assessed carefully since they will vary depending on individual bank circumstances.

Whichever pathway is chosen, banks need to be clear on the value proposition they are pursuing and ensure it is best in class.

And to drive greater consumer engagement, banks can adopt a modular approach and develop a marketplace model of additional features provided by trusted third parties. These features can leverage Open Banking by using APIs (Application Programming Interfaces) to share customers’ financial data (with their consent) with the third party to deliver more personalised and relevant services.

This is important because technology has given customers more freedom when choosing financial products and services – they are attracted to providers that enable them to manage their money safely and more conveniently. As a result, banks are finding that they must reimagine their customer experiences to continue to remain relevant in today’s market. To be successful and to differentiate from the competition, you may choose to develop your mobile banking capability as part of your multi/omni-channel strategy and digitisation roadmap. In addition, you may also decide to create your own standalone digital bank to defend your position in the market, to go after new business or to use as a test and learn for your digital innovations.

Whichever approach a bank takes, for those who get this right, there are significant rewards – increased usage, top of wallet status and a deeper relationship with customers.

Stay current with the latest payments insights from Visa Navigate Europe – subscribe today.

1 Forbes, How Millennials and Gen Z could reinvent the banking industry, February 2021: https://www.forbes.com/sites/forbescommunicationscouncil/2021/02/03/how-millennials-and-gen-z-could-reinvent-the-banking-industry/

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Visa.

Share Feedback